The world of income taxes can often be overwhelming, but there are opportunities for relief through income tax waivers.

Income tax waivers are provisions that allow individuals to reduce or eliminate their tax liability based on specific circumstances. Understanding the avenues available for income tax waivers is crucial.

What is a waiver application? (KRA, n.d.)

Where taxpayers fail to pay their taxes or file returns by stipulated due dates, penalties and interest are charged in accordance with the law. The penalty and interest are tax that are payable. However, they may apply to the Commissioner to remit such penalties and interest. This provision covers only penalty and interest. The principal tax has to be settled in full.

This application by a taxpayer for consideration for penalties and interest to be vacated is what is known as a waiver application. The Commissioner may remit the penalty and interest in whole or partially, depending on justification and evidence presented. Penalty and interest charged under fraud or tax evasion are excluded from consideration for waiver.

Common Income Tax Waivers:

a. Standard Deductions: Understanding standard deductions is key. Ensure you are aware of the standard deduction amount and whether you qualify for any additional deductions based on your circumstances.

b. Tax Credits: Explore available tax credits, such as those for education expenses, child care, or energy-efficient home improvements. These credits can significantly reduce your overall tax liability.

Application Process:

a. Documentation: Comprehensive documentation is crucial when applying for income tax waivers. Be prepared to provide evidence of your financial situation, changes in life circumstances, and any other relevant information.

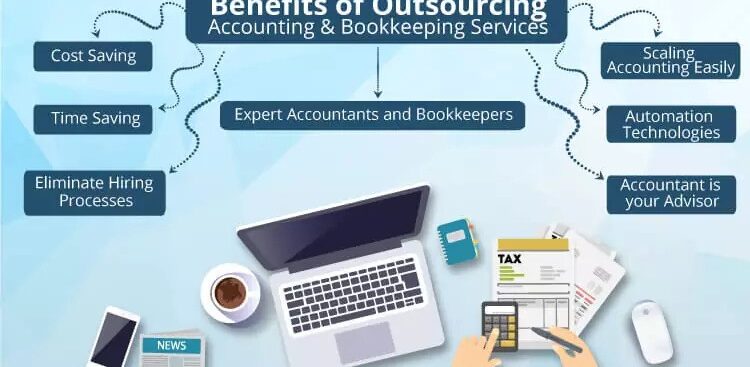

b. Seek Professional Guidance: Consider consulting a tax professional to navigate the complexities of income tax waivers. They can help you identify applicable waivers, ensure accurate documentation, and optimize your overall tax strategy.

Staying Informed and Planning Ahead: Income tax laws can undergo changes, and staying informed is vital. Regularly check for updates from tax authorities and plan ahead to maximize your income tax waivers each year.

Income tax waivers offer a lifeline for individuals navigating the challenges of taxation. By understanding the eligibility criteria, exploring available waivers, and staying informed about changes in tax laws, you can optimize your financial strategy and potentially reduce your income tax burden.