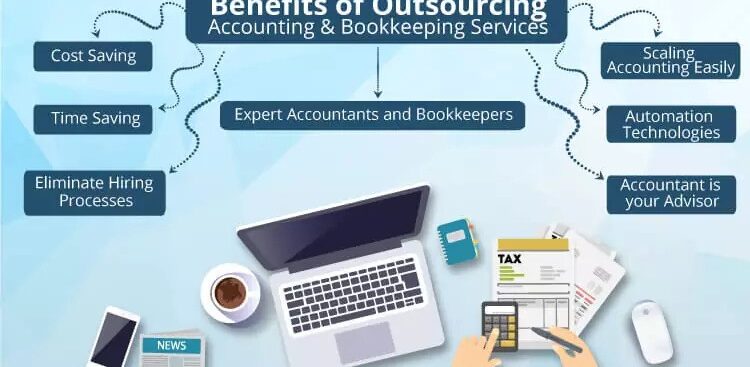

In the ever-evolving landscape of business, strategic decisions can make the difference between success and stagnation. We’ll explore the compelling reasons why including outsourced accounting in your business strategy can be a game-changer, offering benefits that extend far beyond cost savings.

Cost Efficiency:

- Operational Cost Reduction:

Outsourcing accounting allows businesses to significantly reduce operational costs associated with hiring, training, and maintaining an in-house accounting team. This cost efficiency is particularly beneficial for small and medium-sized enterprises (SMEs).

- Access to Expertise:

By outsourcing, you gain access to a pool of accounting professionals with specialized expertise in various domains. This ensures that your financial tasks are handled by skilled professionals without the need for extensive training on your end.

Focus on Core Competencies:

- Strategic Business Focus:

Outsourcing accounting enables your in-house team to concentrate on core business activities, such as product development, customer service, and business expansion. This strategic focus can drive overall business growth and innovation.

- Time Management:

Freeing up your team from routine accounting tasks allows them to allocate time more efficiently. This not only enhances productivity but also fosters a more agile and adaptable work environment.

Scalability and Flexibility:

- Adapting to Growth:

Outsourced accounting services can easily scale up or down based on your business’s changing needs. Whether you’re experiencing rapid growth or navigating a lean period, outsourcing provides the flexibility to adjust resources accordingly.

- Access to Advanced Technologies:

Outsourcing firms often invest in cutting-edge accounting technologies. By leveraging these tools, your business can benefit from the latest software and systems without incurring the upfront costs of acquiring and maintaining them in-house.

Risk Mitigation:

- Compliance and Accuracy:

Outsourced accounting firms are well-versed in regulatory requirements and stay abreast of changes in accounting standards. This ensures that your business remains compliant, reducing the risk of financial penalties and legal issues.

- Data Security:

Reputable outsourcing partners prioritize data security, implementing robust measures to safeguard sensitive financial information. This can be especially critical in an era where cybersecurity threats are prevalent.

Enhanced Reporting and Insights:

- Timely and Accurate Reporting:

Outsourced accounting firms are equipped to provide timely and accurate financial reports, giving your business access to crucial insights for decision-making. This can be instrumental in developing effective strategies and responding to market trends.

- Strategic Financial Planning:

Outsourced professionals often bring a fresh perspective to financial planning. Their expertise can contribute to more informed decision-making, helping your business navigate economic uncertainties and capitalize on opportunities.

Incorporating outsourced accounting into your business strategy goes beyond mere cost-cutting; it’s a strategic move towards efficiency, scalability, and heightened financial acumen. By leveraging external expertise, your business can focus on what it does best, while skilled professionals handle the intricacies of financial management. Whether you’re a start-up or an established enterprise, outsourcing accounting can be a catalyst for sustainable growth and long-term success in today’s competitive business landscape.